-40%

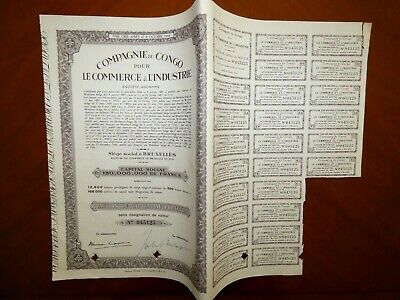

Compagnie Industrielle Africaine,share certificate 1928

$ 2

- Description

- Size Guide

Description

One share certificate of one bearer "part sociale " of"COMPAGNIE INDUSTRIELLE AFRICAINE

"(

C.I.A.)Société Congolaise à responsabilité limitée. Elisabethville ( Belgian Congo). 1928. Condition (opinion) Fine/Very Fine (F/VF).Printer :Imprimerie Industrielle et Financière

.Capital 29 million francs.

All 29 coupons remain uncut.Established 1926.One hand signature.

Trade- import of Belgian industrial products to the Congo.

---------------------------------------------------------------------------

See some information found on the web in English and French below.

Postage, including packing material, handling fees : Europe: USD 4.10 / USA $ 4.90. Rest of the World: USD 5.50

FREE of postage for any other additional banknote , stocks & bonds or other items

Only one shipping charge per shipment (the highest one) no matter how many items you buy (combined shipping).

-------------------------------------------------------------------------

Guaranteed genuine-

.

One

month

return

policy

(retail sales)

Full refund policy ,including shipping cost,guaranteed in case of lost or theft after the completion of the complaint with Spanish Correos for the registered letters (normally purchases above $ 40.00).

Customers are invited to combine purchases to save postage.

Banknote Grading

UNC

AU

EF

VF

F

VG

G

Fair

Poor

Uncirculated

About Uncirculated

Extremely Fine

Very Fine

Fine

Very Good

Good

Fair

Poor

Edges

no counting marks

light counting folds OR...

light counting folds

corners are not fully rounded

much handling on edges

rounded edges

Folds

no folds

...OR one light fold through center

max. three light folds or one strong crease

several horizontal and vertical folds

many folds and creases

Paper

color

paper is clean with bright colors

paper may have minimal dirt or some color smudging, but still crisp

paper is not excessively dirty, but may have some softness

paper may be dirty, discolored or stained

very dirty, discolored and with some writing

very dirty, discolorated, with writing and some obscured portions

very dirty, discolored, with writing and obscured portions

Tears

no tears

no tears into the border

minor tears in the border, but out of design

tears into the design

Holes

no holes

no center hole, but staple hole usual

center hole and staple hole

Integrity

no pieces missing

no large pieces missing

piece missing

piece missing or tape holding pieces together

......

In Scouts, we realize good deeds.

But the Exchange also, you realize (sell) shares, good or less good.

Buy and sell shares, it is the sole business of the holding company of Guy Paquot, Compagnie du Bois Sauvage.

It produces nothing, feeding on dividends from other companies.

The Paquot have made a fortune in the mines, including coal Hope and Good Fortune Montegnée (Liège), has led Guy Paquot father (1905-1988).

They also find themselves in control of Surongo, Congolese mining company founded in 1926, but, late 20th century, is now a holding company.

In 1969, Guy Paquot son joined Nagelmackers, the oldest bank in the country, also from Liège.

In 1986 he became chairman and managing director of Financière Lecocq, which controls the bank Nagelmackers.

The largest shareholder of Financière Lecocq none other than Surongo.

In 1990, the bank was sold to Nagelmackers BNP Paribas, before being integrated into Delta Lloyd Group.

But the Financial Lecocq has many other assets.

In 1994, she is transformed into the Compagnie du Bois Sauvage, consists of 19 companies, some centuries old, with various activities.

Now, Wild Woods has interests in real estate (Cofinimmo), industry (Recticel, Umicore, etc..), Food (including 100% of the chocolatier Neuhaus) and finance (including 16% of the bank

Degroof prestigious Brussels institution specializing in the management of large fortunes).

-------------------------------------------------

Chez les scouts, on réalise de bonnes actions. Mais à la Bourse aussi, on réalise (vend) des actions, bonnes ou moins bonnes. Achetez et vendre des actions, c’est l’unique activité du holding de Guy Paquot, la Compagnie du Bois Sauvage. Elle ne produit rien, se nourrissant des dividendes d’autres sociétés.

Les Paquot ont fait fortune dans les mines, notamment les charbonnages Espérance et Bonne-Fortune à Montegnée (Liège), qu’a dirigés Guy Paquot père (1905-1988). Ils se retrouveront aussi aux commandes de

Surongo

, société

minière

congolaise fondée en 1926, mais qui, fin du 20e siècle, n’est plus qu’un holding.

En 1969, Guy Paquot fils rejoint Nagelmackers, la plus vieille banque du pays, également d’origine liégeoise. En 1986, il devient président et administrateur délégué de Financière Lecocq, qui contrôle la banque Nagelmackers. Le premier actionnaire de la Financière Lecocq n’est autre que

Surongo

.

En 1990, la banque Nagelmackers est cédée à BNP Paribas, avant d’être intégrée au groupe Delta Lloyd. Mais la Financière Lecocq possède encore bien d’autres actifs. En 1994, elle est transformée en Compagnie du Bois Sauvage, regroupement de 19 sociétés, dont certaines centenaires, aux activités diverses.

Aujourd’hui, Bois Sauvage possède des participations dans l’immobilier (Cofinimmo), l’industrie (Recticel, Umicore, etc.), l’alimentation (dont 100 % du chocolatier Neuhaus) et la finance (dont 16 % de la banque Degroof, prestigieuse institution bruxelloise spécialisée dans la gestion des grosses fortunes).

Your browser does not support JavaScript. To view this page, enable JavaScript if it is disabled or upgrade your browser.